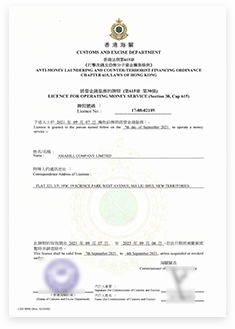

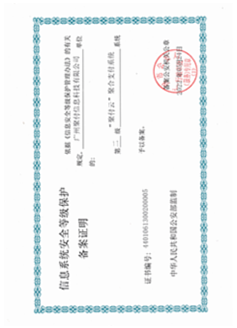

YiiiPay Company Limited, owns a professional team with more than 10 years of experience in online payment services, which is a payment service provider based in Hong Kong. The goal of our company is to focus on helping Hong Kong enterprises going international for business, providing online global capital collection and cross-border payment management solution. Including designing the industry solutions that integrate scenario-based payment channels and virtual account.

We provide “one-to-one”consulting services, customized solution for payment scenarios required by overseas companies for online operations to be better help them achieve flexible management of funds during operations.